san antonio local sales tax rate

2020 rates included for use while preparing your income. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Tax Rates And Local Exemptions Across Texas San Antonio Report

Monday - Friday 745 am - 430 pm Central Time.

. Rates will vary and will be posted upon arrival. The Fiscal Year FY 2023 MO tax rate is 33011 cents. This is the total of state and county sales tax rates.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. While many other states allow counties and other localities to collect a local option sales tax Texas. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax.

The latest sales tax rate for San Antonio TX. San Antonio TX 78283-3966. Local Code Local Rate Total Rate.

City of San Antonio Property Taxes are billed and collected by the Bexar. Look up 2022 sales tax rates for San Antonio Texas and surrounding areas. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax.

The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Tax rates are provided by Avalara and updated monthly. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax.

2020 rates included for use while preparing your income tax deduction. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. There is no applicable county tax.

The outbreak of COVID-19 caused by the. This rate includes any state county city and local sales taxes. The city of Fair Oaks Ranch withdrew from the San Antonio MTA effective September 30 2008.

What is the sales tax rate in San Antonio Florida. The city of Von Ormy withdrew from the San Antonio MTA effective September 30 2009. The latest sales tax rate for San Antonio NM.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The minimum combined 2022 sales tax rate for Bexar County Texas is. This is the total of state county and city sales tax rates.

This rate includes any state county city and local sales taxes. The property tax rate for the City of San Antonio consists of two components. This includes the rates on the state county city and special levels.

Maintenance Operations MO and Debt Service. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The latest sales tax rate for San Antonio FL.

The minimum combined 2022 sales tax rate for San Antonio Florida is. The Texas state sales tax rate is currently. Jurors parking at the garage.

Texas Comptroller of Public Accounts. City sales and use tax codes and rates.

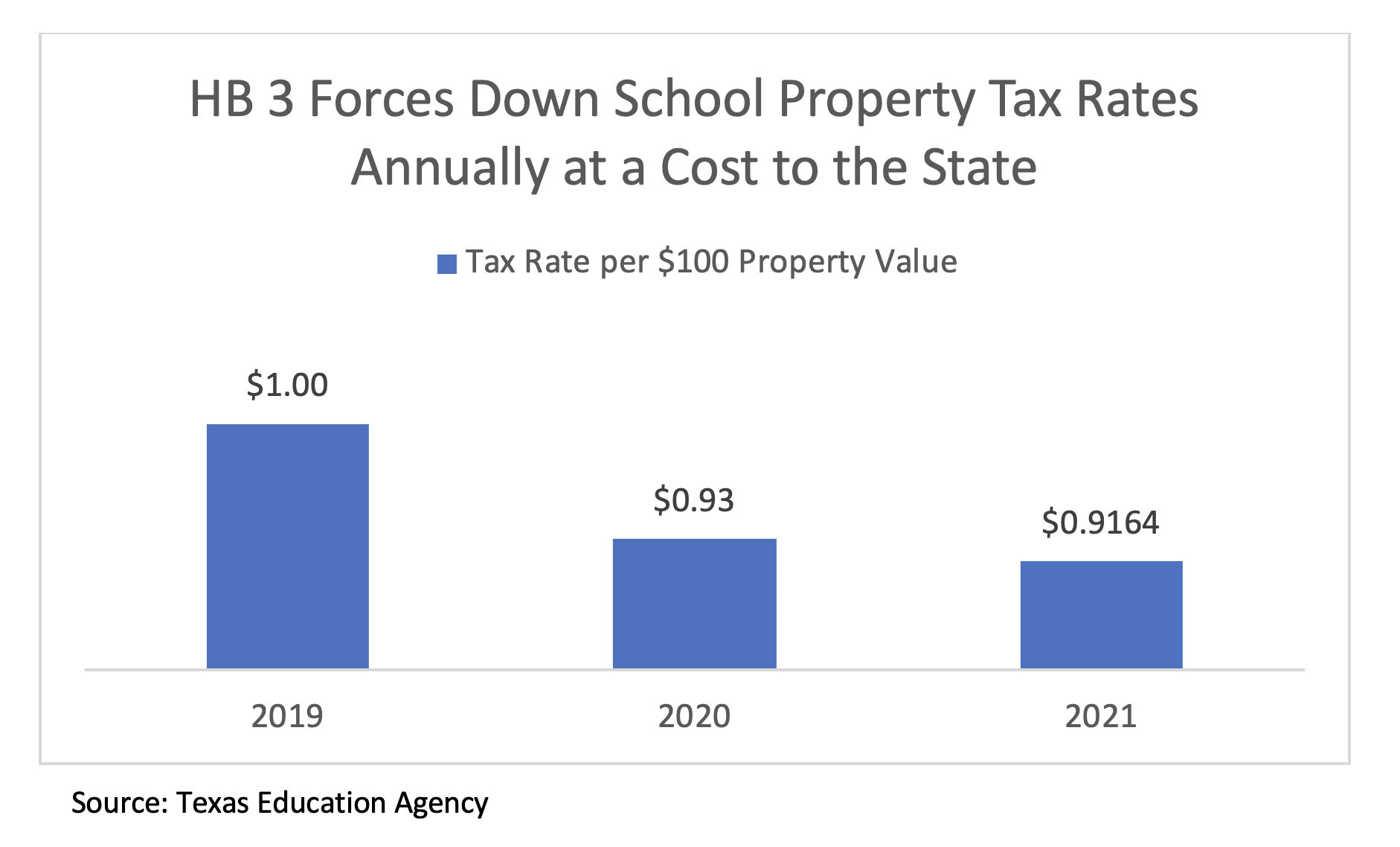

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding Tax Rate Discrepancies

Market Information Schertz Economic Development Corporation

U S Cities With The Highest Property Taxes

Most Texans Pay More In Taxes Than Californians Reform Austin

Texas Sales Tax Rate Changes January 2019

13 Things To Know Before Moving To San Antonio Smartasset

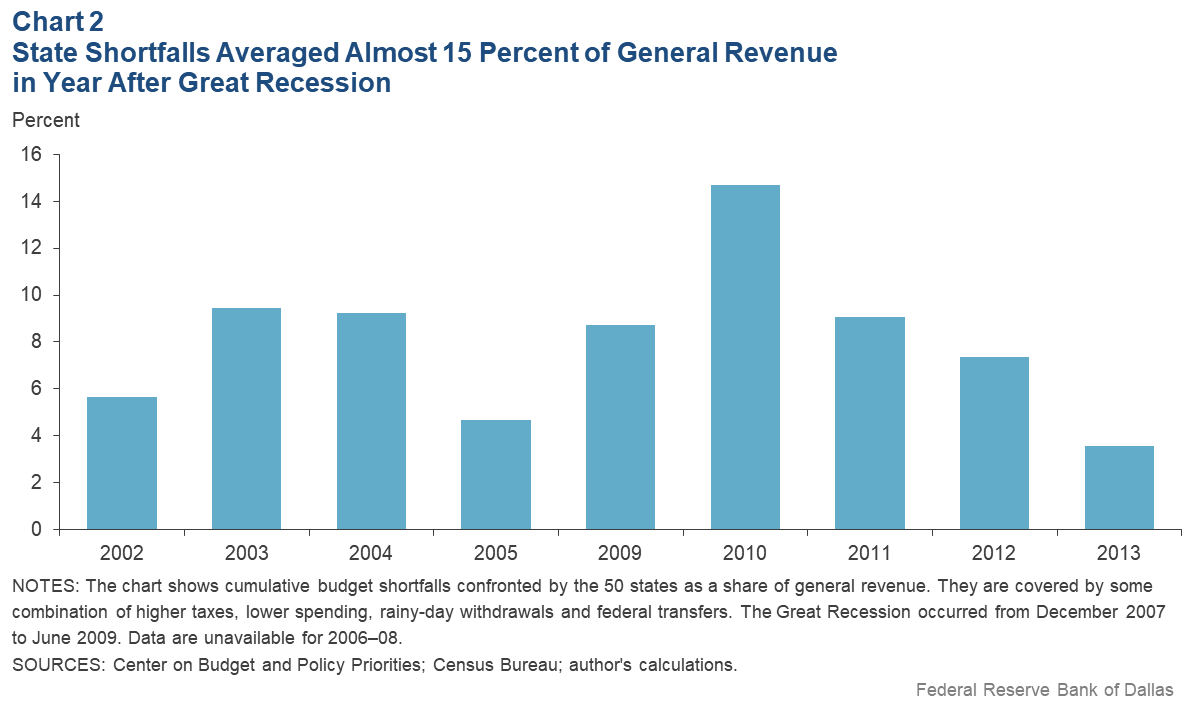

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

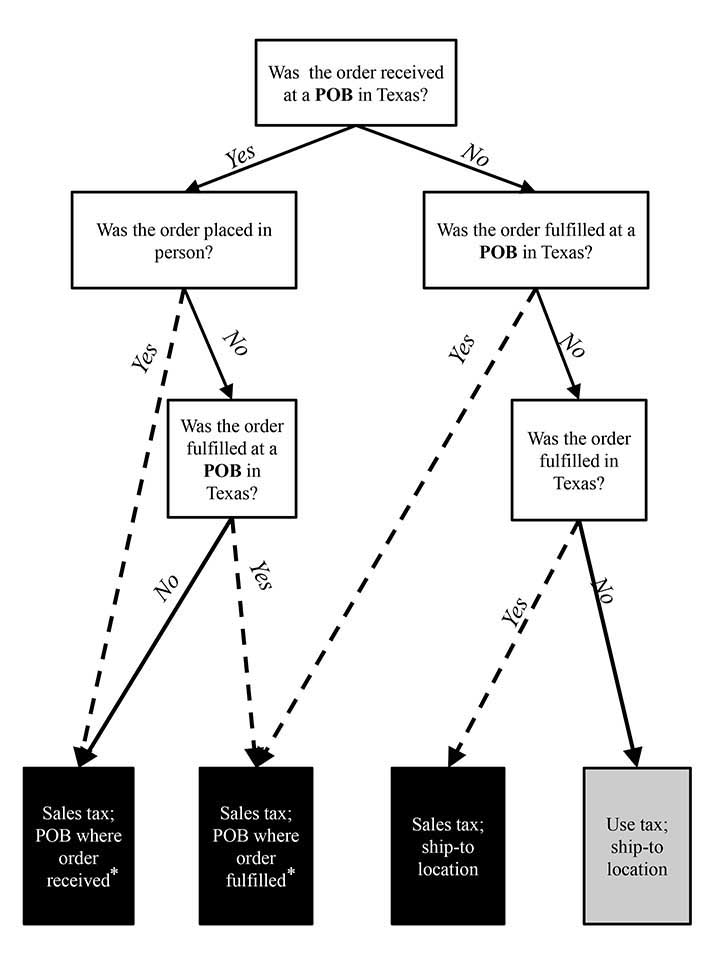

Local Sales And Use Tax Collection A Guide For Sellers

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/85e20dce251581d7db5bf518e23efd18/06_Abbott_State_of_the_State_MG.jpg)

Texas Sales Tax Increase Would Hit Poor People The Hardest The Texas Tribune

Yes Texans Actually Pay More In Taxes Than Californians Do

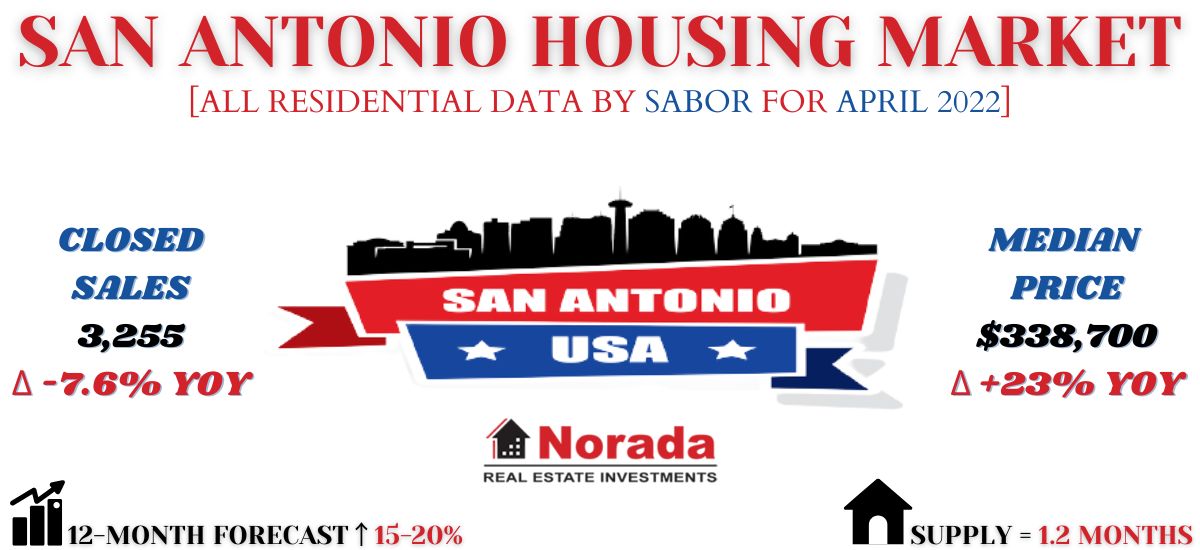

San Antonio Real Estate Market Prices Trends Forecast 2021 2022

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Texas Sales Tax Guide For Businesses